On Wednesday, April 8, 2014, at approximately 11:45 AM, a Montgomery County Sheriff’s Office K-9 Unit conducted a traffic stop on a vehicle that had been traveling northbound on Interstate 45 near Calvary Road. During the traffic stop and investigation, the Deputy established reason to request consent to search the vehicle, which was denied by the driver. The Deputy deployed his canine partner which alerted to the odor of a narcotic inside the vehicle. After the dog alerted, the driver stated marijuana was recently smoked inside the vehicle. A search of the vehicle was conducted and a backpack was located in the back seat of the vehicle that contained a large amount of United States currency. The driver and a passenger both denied ownership of the backpack and money. Both the driver and passenger were detained and the money was seized. Montgomery County Special Investigation Units and representatives of the Montgomery County District Attorney’s Office were called out and assisted in the investigation. The driver and passenger were arrested and charged with felony money laundering. The money seized was later counted and totaled more than $200,000.00.

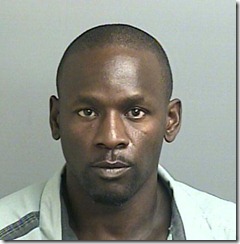

Clarence Adams, Jr. (date of birth 11/22/1985)

Charged with felony money laundering

Cedric Ray Tatum (date of birth 08/20/1973)

Charged with felony money laundering

The Money Laundering Control Act of 1986 (Public Law 99-570) is a United States Act of Congress that made money laundering a federal crime. It was passed in 1986. It consists of two sections, 18 U.S.C. § 1956 and 18 U.S.C. § 1957. It for the first time in the United States criminalized money laundering. Section 1956 prohibits individuals from engaging in a financial transaction with proceeds that were generated from certain specific crimes, known as “specified unlawful activities” (SUAs). Additionally, the law requires that an individual specifically intend in making the transaction to conceal the source, ownership or control of the funds. There is no minimum threshold of money, nor is there the requirement that the transaction succeed in actually disguising the money. Moreover, a “financial transaction” has been broadly defined, and need not involve a financial institution, or even a business. Merely passing money from one person to another, so long as it is done with the intent to disguise the source, ownership, location or control of the money, has been deemed a financial transaction under the law. Section 1957 prohibits spending in excess of $10,000 derived from an SUA, regardless of whether the individual wishes to disguise it. This carries a lesser penalty than money laundering, and unlike the money laundering statute, requires that the money pass through a financial institution. [1]

Comments are closed.